How to Pay Yourself MORE from Your Business Today

Many entrepreneurs struggle to pay themselves a decent salary. Or worse, they fail to pay themselves at all. I'm a firm believer that business owners need to financially prioritize themselves more! In this post, we'll break down exactly how to start paying yourself properly from your business.

When Should You Start Paying Yourself?

Entrepreneurs have a bit of a martyr complex when it comes to paying themselves out of their business. We think that we need to reach a certain point in our businesses before it’s time to benefit from it.

But ask yourself, “Would I expect someone else to do all this work for FREE?”

Entrepreneurs don’t always want to pay themselves, and then they wonder why they’re feeling overworked and burnt out, losing all passion for their business.

So the answer to this question of “When?”…is now.

Even if all you can afford to pay yourself is pocket change, get into the habit of paying yourself something first. You can grow over time.

How Does an Entrepreneur Pay Themselves?

If you are a sole proprietor or an LLC, you pay yourself out of your profits. If you are an S Corporation, you pay yourself as an employee which is treated like any other business expense. In this post, I’m focusing on the former business structure.

Traditional financial teachings will have you pay yourself out of whatever is left over after expenses. However, because this approach often leads to there not actually being any leftovers, I prefer the Profit First Method.

This method involves setting aside a percentage of your revenue for your profit (savings), taxes, and your owner’s pay BEFORE you spend any of that money. Then, the leftovers are your remaining budget for expenses (which helps you to be more intentional with your costs).

Read more about The Profit First System here!

So do I just transfer money into my personal bank account?

When you go to pay yourself, yes. However, I would encourage you to take the Profit First approach of setting aside a fund for your paycheck instead.

This way, you can decide on a set salary you feel your business is reasonably able to afford and draw that out on a consistent schedule of your choosing. If your Pay fund has more money in it after you take your salary, that just means you’re ahead of the game for your next paycheck! If you’re consistently ahead, then it’s time for a raise.

Ideally, in a good month, you can pay yourself. In a great month, you have extra. In a bad month, you can still cover your paycheck because of the great month you had.

When you take this approach, you can create the stability and consistency in your personal finances that you might have been craving.

How Much Can I Pay Myself?

When you’re first starting, this number will be dictated by how much you can afford to spare from your business. It will take time to work towards your ideal.

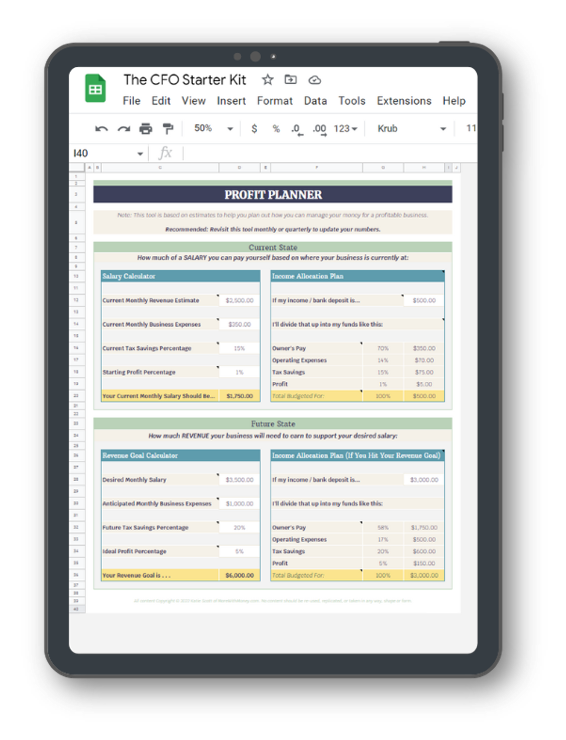

Here’s the math you can follow (though I also have a calculator you can use):

What is my current average monthly revenue?

How much of my revenue (before expenses) should I set aside for taxes? (15% is a good starting point, but I recommend seeking a personal opinion from a tax professional or CPA)

How much of my revenue (before expenses) should I set aside for profit/savings? (I recommend anywhere from 1-5%)

How much is your current average monthly cost of doing business? (Be sure to account for things like annual renewals and less common expenses that may still arise)

When you subtract out the percentages for taxes and profit and then the dollar amount for your expenses, how much is leftover? There’s your starting salary!

If math wasn’t your favorite subject in school, you can download the FREE CFO Starter Kit to access the calculator I made for you to do all of the above (and more!)

When you get a better handle on your financial management, this number can shift into how much you want to pay yourself.

The Profit Planner found in the FREE CFO Starter Kit

Determining Your Desired Monthly Salary

When thinking about what your desired monthly salary from your business should be, we have to address the relationship between your business and your personal finances.

The reality is, your business and personal finances are closely linked, whether you realize it or not.

If your business is doing well and paying you well, you’ll feel it in your personal life. But if your business is struggling, you’ll feel THAT as well.

But it goes both ways!

If your personal finances are well-handled and streamlined, you’ll have a clear picture of what you need your business to be able to pay you to support your ideal lifestyle. But if your personal finances are struggling, that feeling of chaos and desperation WILL leak into your business.

A lot of what I teach for business finance applies to personal finance as well. You should know your numbers, list out your expenses, identify your sinking funds, create a budget, etc.

If you do this and work on running your personal finances LIKE A BUSINESS, you’ll have a better handle on what your monthly salary should truly be.

The Journey to Your Dream Salary: Step-By-Step

An example of fixed expenses in chronological order in the budget tool YNAB.

Use the Profit Planner in the free CFO Starter Kit to determine your Current State - that is, how much of a salary you can pay yourself based on where your business is currently at.

Use the CFO Starter Kit and this Intro to the Profit First System blog post to start practicing setting aside percentage allocations for your business before all of your money goes to expenses.

Spend time with your personal finances, identifying what your desired monthly salary from your business truly is.

Use the Future State calculator in the Profit Planner of the CFO Starter Kit to calculate your revenue goal for supporting that desired salary and business growth potential.

Every quarter, challenge yourself to shift your percentage allocations closer and closer to your ideal!

Are you ready to take your financial journey to the next level? Then you may be ready to check out the More With Money Academy!

This ever-growing collection of online courses and trainings are specially designed to support entrepreneurs like you on your path to financial wellness. The Academy contains carefully designed courses that are easy to understand and implement so that you can be empowered with the practical concepts, streamlined systems, and powerful mindset to transform your business and personal finances.

Click here to explore what the More With Money Academy has to offer!

Pin for later

I'd love to continue the conversation in the comments! Feel free to share your thoughts.

Until next time!